- Effective property tax rate: 1.71%

- Median property taxes paid: $3,283

- Median home value: $175,800

- Median household income (owner-occupied homes): $82,650

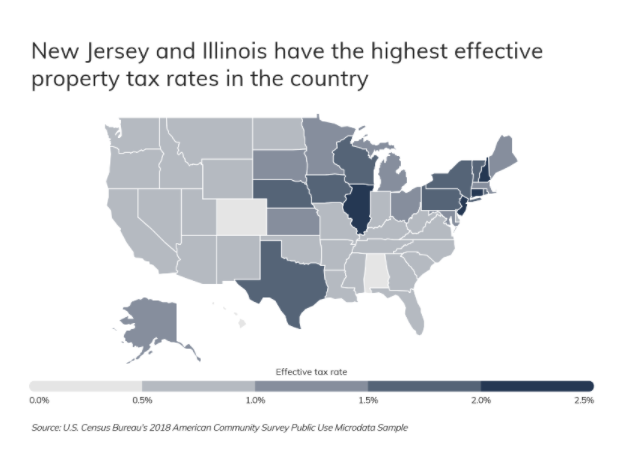

To give some context to these numbers, let’s also look at the nation’s highest and lowest numbers. New Jersey and Illinois residents tend to pay the most in property taxes relative to home values at 2.42 and 2.16%, respectively. Transversely, those living in Hawaii and Alabama have much lower property tax bills, with effective property tax rates of 0.40 and 0.28%.

Inventory is Still the Biggest Challenge for Buyers

Quite simply, there are just more buyers looking for homes than there are homes for sale. According to the National Association of Realtors, total housing inventory is down 18.8% from one year ago. This means a few things, not the least of which is that houses are flying off the market. It’s not rare to see a home on the market for a matter of days, the demand is so high.

We estimate that the housing market is undersupplied by 3.3 million units, and the shortage is rising by about 300,000 units a year. More than half of all states have a housing shortage. -Sam Khater, Chief Economist at Freddie Mac

In a real estate climate like this, it’s vital to have your pre-approval on deck and ready for the moment your dream house hits the market.

Info courtesy of Brent Rasmussen, Mortgage Specialists